Get your car insurance issued instantly 24/7 with Tokio Marine Car Insurance. Experience hassle-free coverage with our quick and accessible claim service.

Protect your home and everything inside whether you own or rent with Tokio Marine Home Insurance. Tailor-made covers for all home protection needs.

Safeguard your journey before you set out! Start your travel insurance with Tokio Marine and explore the world worry-free. Instant insurance in few clicks

Discover the most comprehensive health insurance plans available in the UAE from Tokio Marine, featuring an extensive network of healthcare providers.

Safeguard your business assets and properties effectively by choosing Tokio Marine. Benefit from comprehensive protection tailored to your specific business needs.

Ensure the well-being of your workforce with Tokio Marine's Workmen Compensation Insurance – a reliable solution designed to protect your employees.

Empower your business with Tokio Marine's Business Package Insurance. Tailored to your unique needs, our comprehensive coverage shields against unforeseen risks.

Ensure the success of your events with Tokio Marine's Event Insurance. Our tailored coverage protects against unforeseen disruptions, allowing you to focus on creating memorable experiences.

Have a look at our list of A rated superior garages for your car repair

Know More“The level and value of service which I availed directly from Tokio Marine is second to none. There are several insurance brokers out there but when we compare, we can see that it is highly competitive in terms of value, professionalism, responsiveness, and unique offers to name a few.”

Jani 2589

Jani 2589

“Are several insurance brokers out there but when we compare, we can see that it is highly competitive in terms of value, professionalism, responsiveness, and unique offers to name a few.”

Popy

Popy

“I opened a new company in Jafza and little did I know about the compulsory insurance requirements. I asked a colleague for recommendations, and he said go with Tokio Marine. I contacted Tokio Marine and with 24hrs I got feedback, Jebin was extremely helpful to get things started immediately, he helped me to fill in the forms correctly and cross-check policies against our needs and the Jafza contractual requirements. Within some days all was set and I got my policy documents. Highly recommended insurance service provider.”

Alexander Schnell

Alexander Schnell

“I used their services for my vehicle insurance and I felt the coverage as 'value for money'. The services and assistance from Ms. Christine were very professional and prompt.”

A R Ramees

A R Ramees

“This insurance company is very helpful to its customers. Especially , the service that Ms. Maha provided for me. She was very patient and professional in her work. Her positive attitude made the process easier. Our claim repair, car accident repair, was done efficiently and perfectly.”

Dorin Estakhri

Dorin Estakhri

“I had a good experience with this insurance. I called the company and they provided me with list of garage. I contacted the garage (AG cars) and they told me they can start working on it after a week. My car had a minor accident so it was fine. The company provided me with rental car from quick leas for around d 10 days. Once the car was ready, I went to pick it up and the pick up person from car rental office came to took the car. Over all it was a smooth experience”

Anas Boushie

Anas Boushie

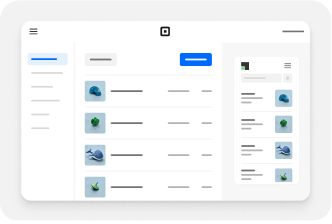

Empowering our brokers with top-tier tools, Tokio Marine ensures support for brokers in efficiently managing their businesses.

Access our products, services, and claims digitally. Get instant insurance within minutes and experience a hassle free experience.

See how easy it isTokio Marine enters into strategic partnership with Dubai Chamber of Digital Economy.

As part of Dubai Fitness Challenge, Tokio Marine organizes Annual Sports Day for employees.

Tokio Marine donates laptops to the children at Al Noor Training Centre for Persons with Disabilities.

Tokio Marine Holdings get ranked as one of the largest P&C Insurers in the world by S&P Global.

To report a motor-related claim, you can submit the claim online. When you report the claim, you will need to upload the police report as well.

In case you wish to cancel your existing policy with us, please feel free to reach out to our office number or fill out the endorsement form online.

We provide recovery services through third party service from AAA Roadside Assistance. To avail the same, call on their helpline number 600 50 8181 .